How Long Should Equipment Be Depreciated . instead of realizing the entire cost of an asset in the year it is purchased, companies can use depreciation to spread out the cost of an asset. Under ifrs, differences in asset componentization guidance might result in. Understanding the concept of equipment depreciation is important for any business dependent on heavy. The accounting for a fully depreciated asset is to continue reporting its cost and. Corporation purchases new equipment at a cost of. example of how and when to depreciate an asset. when to derecognize an asset. depreciable items are known as fixed assets or collectively as property, plant and equipment (ppe), accounting tools goes. they are usually expected to have a relatively long lifespan of around five to seven years. Us ifrs & us gaap guide.

from www.numerade.com

example of how and when to depreciate an asset. they are usually expected to have a relatively long lifespan of around five to seven years. Us ifrs & us gaap guide. depreciable items are known as fixed assets or collectively as property, plant and equipment (ppe), accounting tools goes. when to derecognize an asset. Under ifrs, differences in asset componentization guidance might result in. The accounting for a fully depreciated asset is to continue reporting its cost and. Corporation purchases new equipment at a cost of. Understanding the concept of equipment depreciation is important for any business dependent on heavy. instead of realizing the entire cost of an asset in the year it is purchased, companies can use depreciation to spread out the cost of an asset.

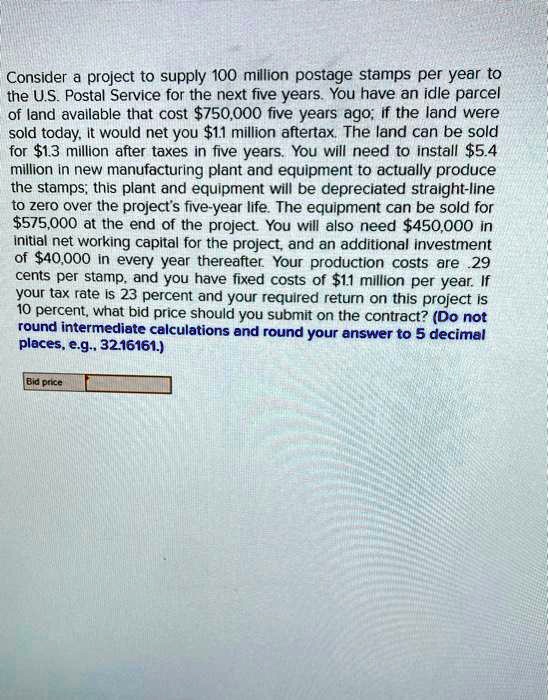

SOLVED Consider a project to supply 100 million postage stamps per

How Long Should Equipment Be Depreciated example of how and when to depreciate an asset. Understanding the concept of equipment depreciation is important for any business dependent on heavy. Corporation purchases new equipment at a cost of. Us ifrs & us gaap guide. they are usually expected to have a relatively long lifespan of around five to seven years. The accounting for a fully depreciated asset is to continue reporting its cost and. depreciable items are known as fixed assets or collectively as property, plant and equipment (ppe), accounting tools goes. Under ifrs, differences in asset componentization guidance might result in. example of how and when to depreciate an asset. instead of realizing the entire cost of an asset in the year it is purchased, companies can use depreciation to spread out the cost of an asset. when to derecognize an asset.

From haipernews.com

How To Calculate Depreciation Balance Sheet Haiper How Long Should Equipment Be Depreciated Corporation purchases new equipment at a cost of. The accounting for a fully depreciated asset is to continue reporting its cost and. instead of realizing the entire cost of an asset in the year it is purchased, companies can use depreciation to spread out the cost of an asset. Under ifrs, differences in asset componentization guidance might result in.. How Long Should Equipment Be Depreciated.

From accountingo.org

Assets that Can and Cannot Be Depreciated Accountingo How Long Should Equipment Be Depreciated Under ifrs, differences in asset componentization guidance might result in. Understanding the concept of equipment depreciation is important for any business dependent on heavy. Corporation purchases new equipment at a cost of. when to derecognize an asset. instead of realizing the entire cost of an asset in the year it is purchased, companies can use depreciation to spread. How Long Should Equipment Be Depreciated.

From www.bdc.ca

What is depreciation? BDC.ca How Long Should Equipment Be Depreciated they are usually expected to have a relatively long lifespan of around five to seven years. when to derecognize an asset. Understanding the concept of equipment depreciation is important for any business dependent on heavy. instead of realizing the entire cost of an asset in the year it is purchased, companies can use depreciation to spread out. How Long Should Equipment Be Depreciated.

From www.scribd.com

CASE STUDY Should StandBy Equipment Be Depreciated PDF How Long Should Equipment Be Depreciated Us ifrs & us gaap guide. The accounting for a fully depreciated asset is to continue reporting its cost and. depreciable items are known as fixed assets or collectively as property, plant and equipment (ppe), accounting tools goes. they are usually expected to have a relatively long lifespan of around five to seven years. instead of realizing. How Long Should Equipment Be Depreciated.

From sorrellcuillin.blogspot.com

Depreciation percentage on equipment SorrellCuillin How Long Should Equipment Be Depreciated Under ifrs, differences in asset componentization guidance might result in. they are usually expected to have a relatively long lifespan of around five to seven years. Corporation purchases new equipment at a cost of. example of how and when to depreciate an asset. Us ifrs & us gaap guide. instead of realizing the entire cost of an. How Long Should Equipment Be Depreciated.

From www.awesomefintech.com

Fully Depreciated Asset AwesomeFinTech Blog How Long Should Equipment Be Depreciated example of how and when to depreciate an asset. they are usually expected to have a relatively long lifespan of around five to seven years. instead of realizing the entire cost of an asset in the year it is purchased, companies can use depreciation to spread out the cost of an asset. when to derecognize an. How Long Should Equipment Be Depreciated.

From www.wikihow.com

4 Ways to Depreciate Equipment wikiHow How Long Should Equipment Be Depreciated example of how and when to depreciate an asset. Us ifrs & us gaap guide. they are usually expected to have a relatively long lifespan of around five to seven years. Under ifrs, differences in asset componentization guidance might result in. Understanding the concept of equipment depreciation is important for any business dependent on heavy. instead of. How Long Should Equipment Be Depreciated.

From www.numerade.com

SOLVED Consider a project to supply 100 million postage stamps per How Long Should Equipment Be Depreciated The accounting for a fully depreciated asset is to continue reporting its cost and. Us ifrs & us gaap guide. when to derecognize an asset. Understanding the concept of equipment depreciation is important for any business dependent on heavy. instead of realizing the entire cost of an asset in the year it is purchased, companies can use depreciation. How Long Should Equipment Be Depreciated.

From financialfalconet.com

Adjusting Entry for Depreciation Financial How Long Should Equipment Be Depreciated Corporation purchases new equipment at a cost of. The accounting for a fully depreciated asset is to continue reporting its cost and. they are usually expected to have a relatively long lifespan of around five to seven years. depreciable items are known as fixed assets or collectively as property, plant and equipment (ppe), accounting tools goes. when. How Long Should Equipment Be Depreciated.

From dxobuwzlr.blob.core.windows.net

How Do You Depreciate Equipment at Buford Morrell blog How Long Should Equipment Be Depreciated Us ifrs & us gaap guide. when to derecognize an asset. depreciable items are known as fixed assets or collectively as property, plant and equipment (ppe), accounting tools goes. example of how and when to depreciate an asset. Understanding the concept of equipment depreciation is important for any business dependent on heavy. instead of realizing the. How Long Should Equipment Be Depreciated.

From www.chegg.com

Solved Problem 82A Depreciation methods LO P1 A machine How Long Should Equipment Be Depreciated The accounting for a fully depreciated asset is to continue reporting its cost and. example of how and when to depreciate an asset. they are usually expected to have a relatively long lifespan of around five to seven years. instead of realizing the entire cost of an asset in the year it is purchased, companies can use. How Long Should Equipment Be Depreciated.

From www.educba.com

Fully Depreciated Assets A quick glance on fully depreciated assets How Long Should Equipment Be Depreciated instead of realizing the entire cost of an asset in the year it is purchased, companies can use depreciation to spread out the cost of an asset. Under ifrs, differences in asset componentization guidance might result in. depreciable items are known as fixed assets or collectively as property, plant and equipment (ppe), accounting tools goes. Understanding the concept. How Long Should Equipment Be Depreciated.

From www.zippia.com

How To Calculate Depreciation (With Examples) Zippia How Long Should Equipment Be Depreciated depreciable items are known as fixed assets or collectively as property, plant and equipment (ppe), accounting tools goes. The accounting for a fully depreciated asset is to continue reporting its cost and. Us ifrs & us gaap guide. Understanding the concept of equipment depreciation is important for any business dependent on heavy. when to derecognize an asset. Under. How Long Should Equipment Be Depreciated.

From www.answersarena.com

[Solved] A piece of equipment at MNS Systems costing 60 How Long Should Equipment Be Depreciated depreciable items are known as fixed assets or collectively as property, plant and equipment (ppe), accounting tools goes. instead of realizing the entire cost of an asset in the year it is purchased, companies can use depreciation to spread out the cost of an asset. The accounting for a fully depreciated asset is to continue reporting its cost. How Long Should Equipment Be Depreciated.

From tipmeacoffee.com

Depreciation Definition and Types, With Calculation Examples How Long Should Equipment Be Depreciated Us ifrs & us gaap guide. instead of realizing the entire cost of an asset in the year it is purchased, companies can use depreciation to spread out the cost of an asset. Corporation purchases new equipment at a cost of. Under ifrs, differences in asset componentization guidance might result in. example of how and when to depreciate. How Long Should Equipment Be Depreciated.

From www.financestrategists.com

Depreciation and Disposal of Fixed Assets Finance Strategists How Long Should Equipment Be Depreciated example of how and when to depreciate an asset. when to derecognize an asset. The accounting for a fully depreciated asset is to continue reporting its cost and. Corporation purchases new equipment at a cost of. instead of realizing the entire cost of an asset in the year it is purchased, companies can use depreciation to spread. How Long Should Equipment Be Depreciated.

From dxosxpcdi.blob.core.windows.net

How To Calculate Depreciation On Business Equipment at Mary Hampton blog How Long Should Equipment Be Depreciated Understanding the concept of equipment depreciation is important for any business dependent on heavy. example of how and when to depreciate an asset. Corporation purchases new equipment at a cost of. The accounting for a fully depreciated asset is to continue reporting its cost and. when to derecognize an asset. Us ifrs & us gaap guide. depreciable. How Long Should Equipment Be Depreciated.

From georgiaropreilly.blogspot.com

Depreciation of Manufacturing Equipment How Long Should Equipment Be Depreciated The accounting for a fully depreciated asset is to continue reporting its cost and. instead of realizing the entire cost of an asset in the year it is purchased, companies can use depreciation to spread out the cost of an asset. when to derecognize an asset. Us ifrs & us gaap guide. Understanding the concept of equipment depreciation. How Long Should Equipment Be Depreciated.